421a tax abatement meaning

It is most commonly granted to property developers in exchange for including affordable housing and the benefit lasts for 10 to 25 years. Andrew cuomo decided to let the real estate board of new york rebny.

What Is The 421g Tax Abatement In Nyc Hauseit

If you are curious you can find the entire collection here.

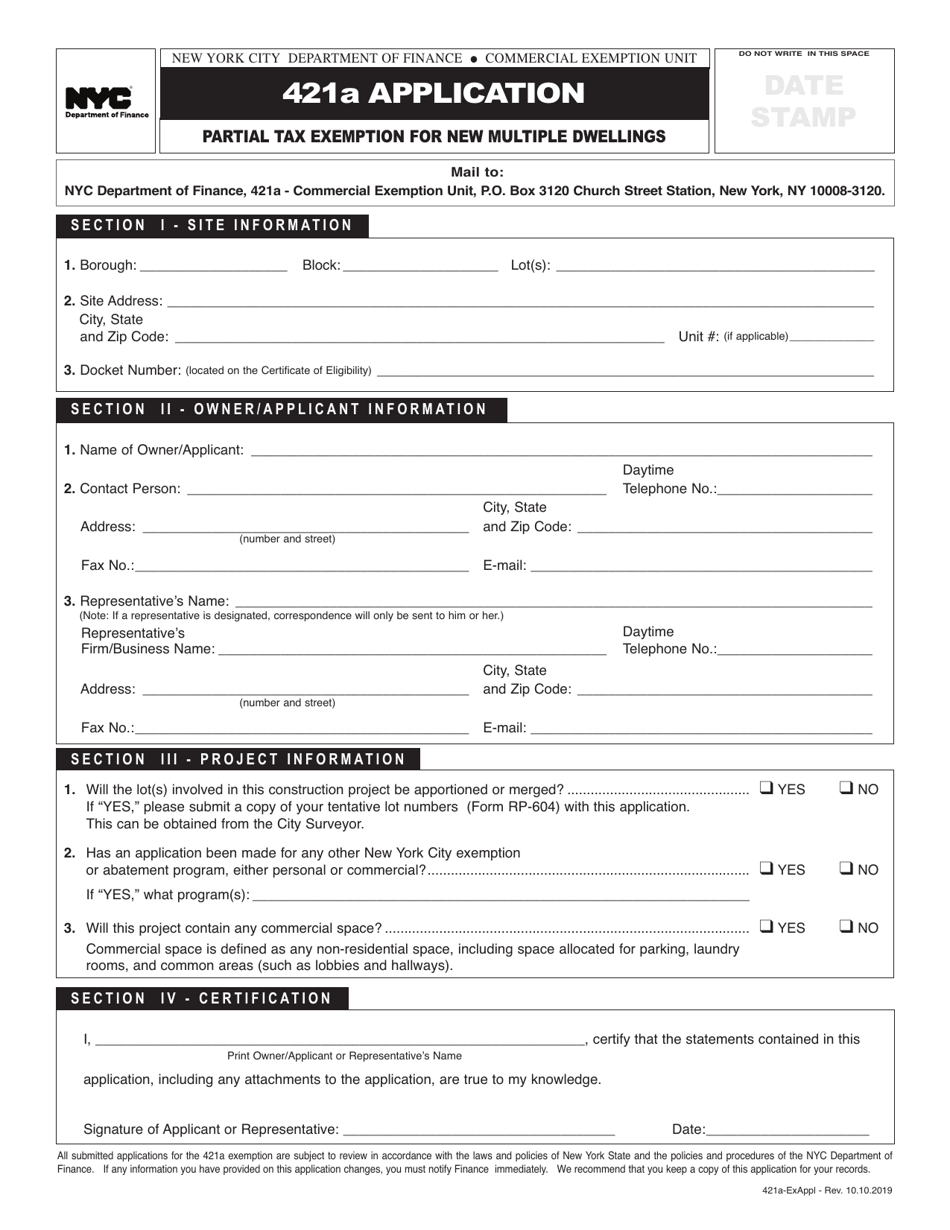

. A 421a tax abatement lowers your property tax bill by applying credits against the total amount you owe. 421a Exemption Property Vehicles Forms Property Owners Business Construction Government and Non-Profits Tenant Programs Get Help 421a Exemption If your property appears in the list of 421a exemptions currently being processed for FY19-20 at the following link 421a exemption and you have a question please contact 421Aexemptionfinancenycgov. The exemption also applies to buildings that add new residential units.

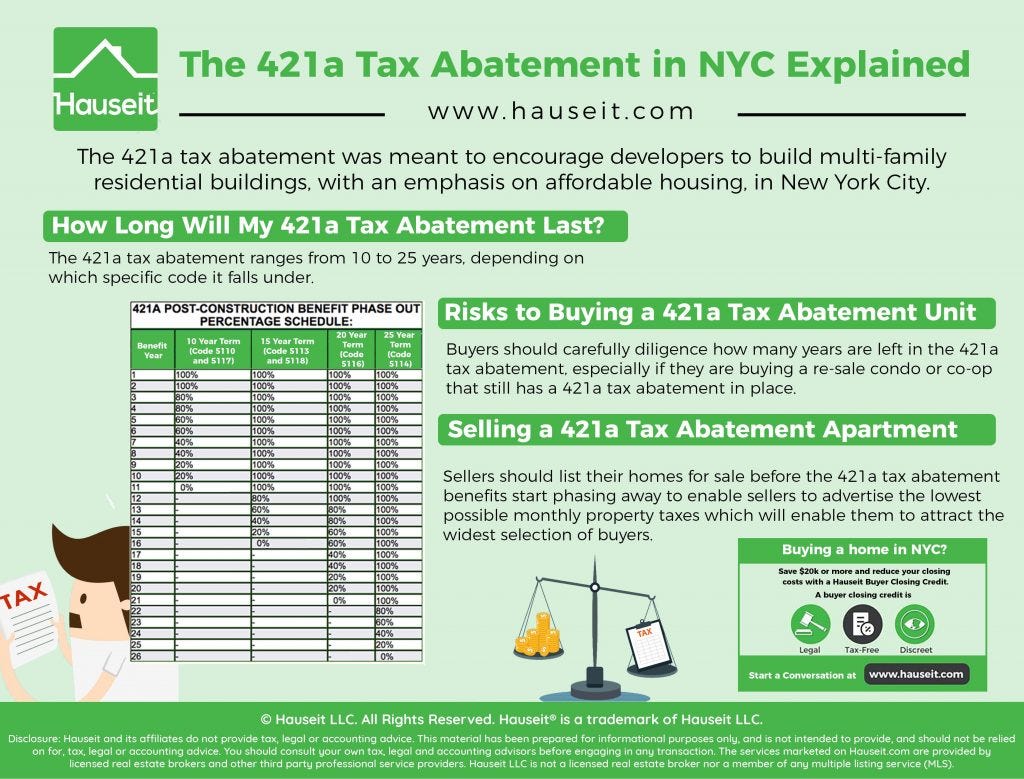

Established a new 421-a tax exemption program for any project that commenced construction between January 1 2016 and June 15 2019 and was completed on or before June 15 2023 New Program and provided that the New Program would not come into effect until representatives of residential real estate developers and construction labor unions signed a. There are multiple variations of the 421a tax abatement ranging from terms. The tax abatement was meant to encourage developers to build multi-family residential buildings with an emphasis on affordable housing in New York City.

Put simply the program gives developers a 10-year tax exemption for building a multi-unit residential project on vacant land. The first 421a tax exemption began in the 1970s as a way to incentivize housing development and has been revised over the years to include affordable housing and construction worker wage requirements a battle over which stalled the program for a year in 2016 when then-gov. The 421a tax abatement is a tax bill granted to property developers and focuses on affordable housing in densely populated areas of New York.

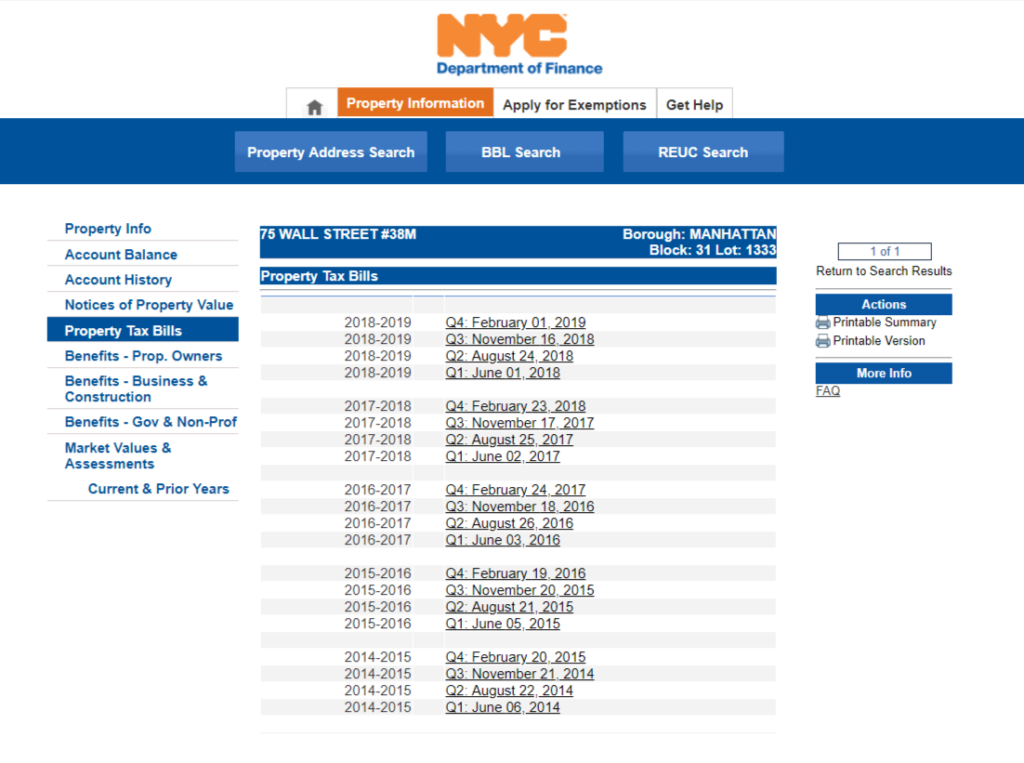

To see the 421a tax reduction type you need to go to the last property tax bill also on the left. Tax abatement or a tax holiday means that a persons tax obligations are reduced by a certain amount. Home buyers can understand the true meaning of mitigation by knowing when it expires.

The most important abatement is arguably the Cooperative and Condominium Property Tax Abatement which reduces property taxes for apartment owners all over the city. While these New York tax benefits are valid for builders for 10 to 20 years they are then passed on to home buyers. While 421a tax abatements get all the attention there are actually many other types offered by NYC.

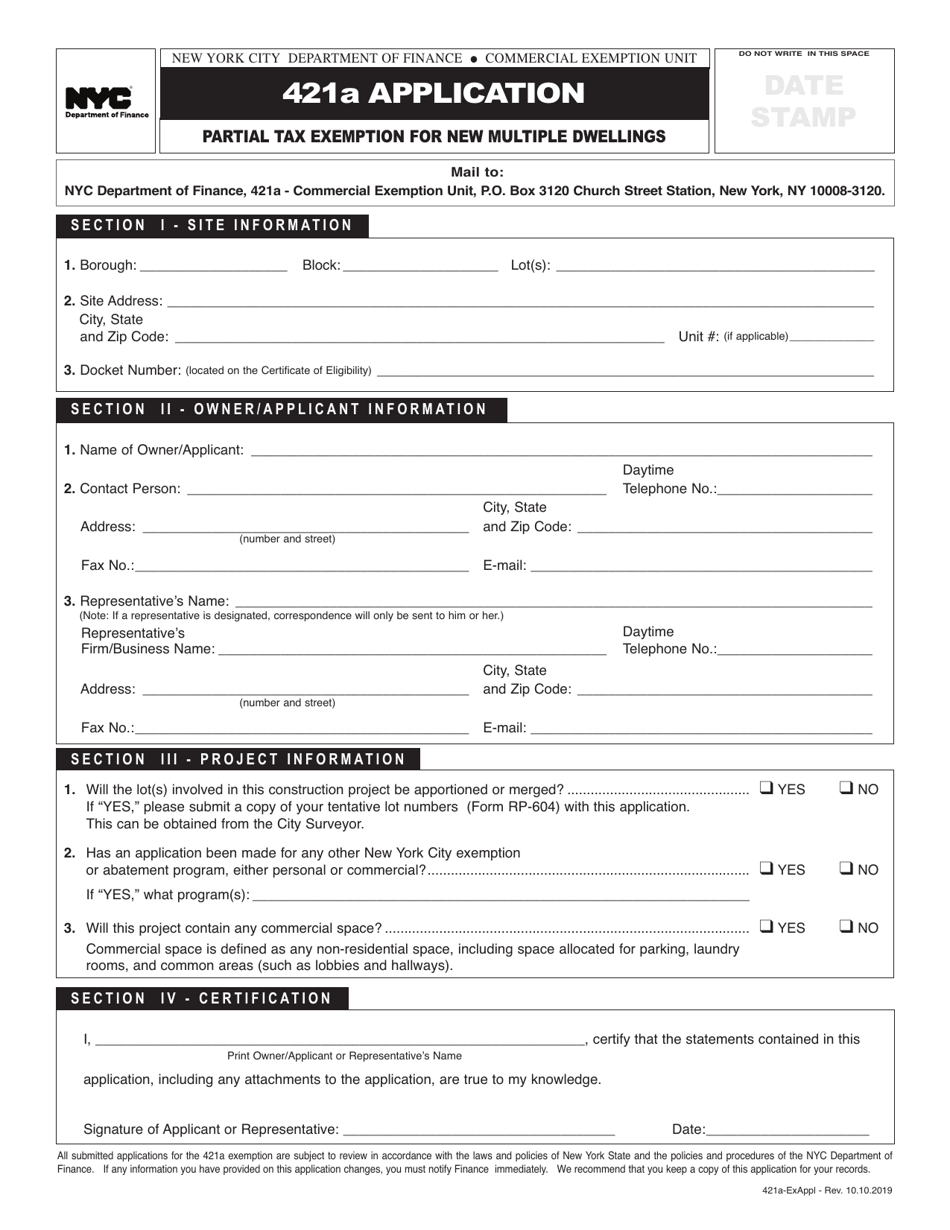

During the time period thousands of New Yorkers were moving upstate or to the suburbs and City officials feared a decline in residential development. The full 421a tax abatement application package includes DHCR rent registration the restrictive declaration and other documents. Department of Finance DOF 421a application After HPD issues a 421a certificate of eligibility a separate 421a application must be filed with NYC Department of Finance DOF.

The previous versions of 421a required that developers set aside 20 percent of the units in a project as affordable in exchange for a tax abatement that ranged from 20 to 25 years depending on where the building was located and how affordable the housing was. So if you buy an apartment with a 421-A abatement youre effectively paying a premium - in this example 190000 - for the apartment in extra principal. Should City Hall mandate prevailing construction wages at affordable housing developments that.

These include the J-51 Program the 421a Program the Senior Citizen Rent Increase Exemption SCRIE the. Tax Abatement in New Jersey. In other words when your taxes are abated it means that your taxes are lowered.

In New York State a 421a Tax Abatement is a tax exemption for real estate developers who build multi-family residential buildings in New York City. 25 years the larger the savings you receive during your period of ownership. What happens when J-51 abatement expires.

One of those perplexing terms is 421a tax abatement. New York City has revived the tax cut to encourage development and boost the economy in the wake of the pandemic. The longer the term of the abatement ie.

If it is not it will most likely utilize a 25-year 421a abatement. And that is the 421a program that New Yorkers have lived with for the past four years. In essence its a tax exemption program given to building developers that typically lowers the property taxes for residential units for some time.

If the owner of a co-op or condominium meets the necessary requirements and is eligible for the rebate annual property taxes on the unit can be reduced from 175 to 281 per year depending on the average estimate of the unit. The 421a tax abatement program remains in limbo and its future hinges on one crucial question. Youre stuck with that extra principal - now in the form of a higher mortgage payment because of the higher principal -.

So how much more is it worth. What is 421-a. When you get a tax abatement the government is essentially giving you a tax break on certain types of real estate property business property or even business opportunities.

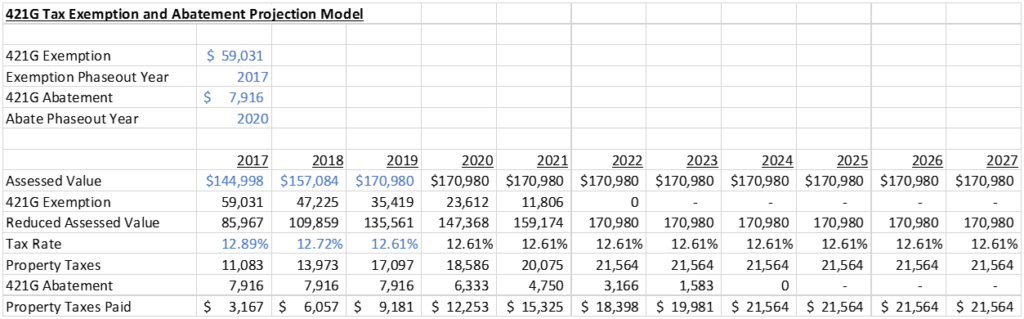

The 421a Exemption gives apartment owners in New York the longest period of tax relief since these last 15 years to 25 years. From these assumptions we. Usually the tax break goes with the property as long as the project continues to qualify.

The key 421a tax abatement benefit in NYC is the reduction in property taxes you owe for the term of the program. The original 421a tax abatement program began in 1971 and is named after section 421-a of the New York Property Tax Law. There are two different tax abatements to take into consideration - if the project is majority owned by a not-for-profit it will be eligible for an as-of-right full 420c tax abatement.

The 421-a tax abatement was created in 1971 to encourage the development of underutilized or unused land by significantly reducing property taxes on newly developed land for a set period of time. If you live in New York you can perform a 421a tax abatement lookup here. Were talking ten years or possibly more which is mighty alluring for home buyers.

New York City has several tax abatement programs in place. Homebuyers can understand the true meaning of the abatement by knowing when it will expire. What Is a 421a Tax Abatement.

Jan 8th 2022 In NYC 421-a tax abatements were introduced in 1971 and were implemented to encourage developers to develop unused and underutilized land by offering them reduced property taxes for a set amount of time typically between 10-25 years. HPD determines if a property is.

421a Tax Abatement Archives Nestapple

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc Tax Abatements Guide 421a J 51 And More Makingnyc Home

Tax Abatement Nyc Guide 421a J 51 And More

Tax Abatement Nyc Guide 421a J 51 And More

What Is The 421g Tax Abatement In Nyc Hauseit

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc Real Estate Taxes 421a Tax Abatements And Manhattan Property Tax

Nyc 421a Tax Abatement What It Is And How You Can Benefit From It

Understanding Rebny S New 421 A Tax Exemption Proposal Association For Neighborhood And Housing Development

What Is A 421a Tax Abatement In Nyc Streeteasy

What Is The 421g Tax Abatement In Nyc Hauseit

New York City 421a Partial Tax Exemption For New Multiple Dwellings Application Download Printable Pdf Templateroller

How To Calculate The Unabated Property Taxes On A Nyc Condo With A 421a Tax Abatement Youtube

Everything You Need To Know About Nyc S 421 A Tax Program By Hauseit Medium

What Is The 421g Tax Abatement In Nyc Hauseit

Tax Abatement Nyc Guide 421a J 51 And More

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo